|

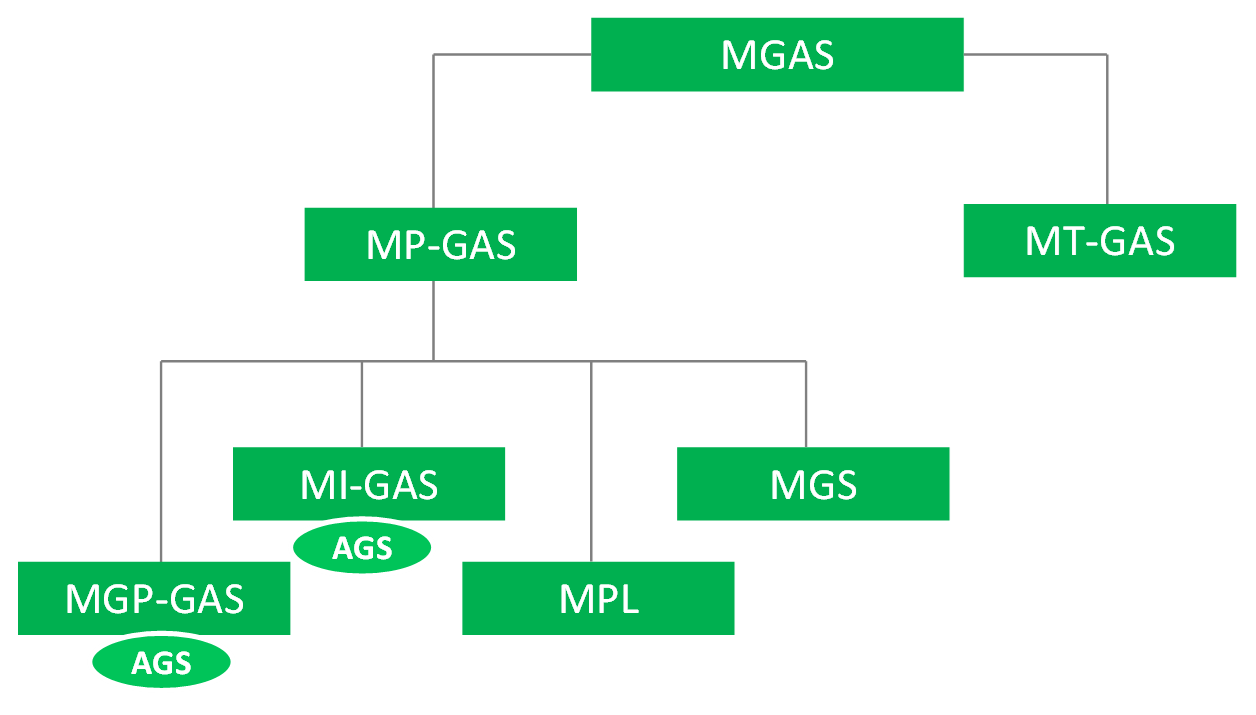

GME organized and manages the natural-gas market (MGAS). In the MGAS, parties authorized to carry out transactions at the “Punto Virtuale di Scambio” (PSV - Virtual Trading Point) may make forward purchases, also functional to balancing of the gas system, and spot purchases and sales of volumes of natural gas.

In the MGAS, GME plays the role of central counterparty to the transactions concluded by Market Participants.

The

MGAS consists of:

Spot gas Market (MPGAS), comprising all the following markets:

-

Day-ahead gas market the day (MGP-GAS).Trading on the MGP-GAS takes place in accordance with the continuous trading mode

and, only for the segment for the supply of system gas (AGS segment), whose session is carried out on gas day G-1 according to the auction trading methods.

As for trading in the MGP-GAS, carried out according the continuous trading method, gas purchase/sale offers/bids related to the three

gas-days after that of the trading session opening are selected.As for the trading in the AGS segment, carried out according to the auction trading methods,

gas purchase/sale offers/bids related to the gas-day after that in which the trading session is carried out, are selected.

-

Intraday gas market (MI-GAS). Trading in the MI-GAS takes place in the manner of continuous trading and,

only for the segment for the supply of system gas (AGS segment), whose session is carried out on gas day G, according

to the auction trading methods. As for trading in the MI-GAS, carried out according to continuous trading methods,

gas purchase/sale offers/bids related to the gas-day corresponding to that of tradinf session opening are selected.

As for the AGS segment trading, which takes place according to the auction trading methods, gas purchase/sale offers/bids

related to the same gas-day in which the trading session takes place, are selected.

- Locational products market (MPL). The MPL takes place in the manner of the auction trading. The MPL sessions are held only upon request of Snam Rete Gas. In this market, authorized users supply Snam Rete Gas with quantities of gas needed to manage the physical demands within the balancing zone or deviations provided between overall injections and withdrawals on the network.

- Regulated Market for the trading of gas stored (MGS). The MGS takes place in the manner of auction trading. Bids/offers of gas stored may be traded in the MGS by authorized users, and by Snam Rete Gas.

- Forward Gas Market (MT-GAS). The MT-GAS takes place under the continuous-trading mechanism. In the MT-GAS, gas demand bids and supply offers are selected from as many order books as the types of tradable contracts for the different delivery periods. The types of tradable products are defined in the Technical Rules.

* * * *

For the purposes of the market:

a. applicable period: the gas-day (period of 24 consecutive hours beginning at 6:00 a.m. of each calendar day and ending at 6:00 a.m. of the next calendar day);

b. the unit of measurement of unit gas prices is Euro/MWh, specified with three decimals;

c. On MGP-GAS, MI-GAS and MT-GAS:

- 1 contract is equal to 1 MW;

- the unit of measurement of the contracts is the MW, without any decimal places;

- the volume of gas underlying each contract (contract size), expressed in MWh/day, is obtained as a product between 1 MW, 24 (number of hours per gas day) and the number of relevant periods (gas-days) covered by the contract itself.

- in the AGS section, the maximum limit of the offer price is equal to 500 €/MWh

On MPL:

- 1 contract is equal to 1 MW;

- the unit of measurement of the contracts is the MW, specified with three decimal places;

- the volume of gas underlying each contract (contract size), expressed in MWh/day, is obtained as a product between 1 MW, 24 (number of hours per gas day) and the number of relevant periods (gas-days) covered by the contract itself.

- the maximum limit of the offer price is equal to 500 €/MWh

On MGS:

- 1 contract is equal to 1 MWh/day;

- the unit of measurement of the contracts is MWh, specified with 3 decimal places;

- the volume of gas underlying each contract (contract size), expressed in MWh/day, is obtained as a product between 1 MWh and the number of relevant periods (i.e. one gas-day) covered by the contract itself.

- the maximum limit of the offer price is equal to 500 €/MWh

The sessions of the MGAS take place according to the following timetable:

-

MGP-GAS:

- trading organized according to the continuous trading methods take place:

-

for daily products (products with delivery times equal to the gas-day) referring to the three following

gas-days, every day, from 06.00 am to 02.30 am of the next calendar day. Therefore, the gas-day G will be tradeable in:

- trading organized according to the continuous trading methods take place:

- G-3: from 06:00 am of the calendar day G-3 to 02:30 am of the calendar day G-2

- G-2: from 06:00 am of the calendar day G-2 to 02:30 am of the calendar day G-1

- G-1: from 06:00 am of the calendar day G-1 to 02:30 am of the calendar day

-

for the weekend product (product with delivery period equal to single consecutive

gas-days corresponding, respectively, to Saturday and Sunday), on Thursday and

Friday from 06:00 am to 02:30 am of the following calendar day. Therefore, the weekend product will be tradeable:

- trading organized according to the continuous trading methods take place:

- from 06:00 am on Thursday to 02:30 am on Friday

- from 06:00 am on Friday to 02:30 am on Saturday

- The AGS segment auction takes place every day according to the following schedule:

-

the session for the submission of bids/offers opens at 08:00 am and ends at 1:30 pm

of the gas-day preceding the gas-day (G) subject to trading;

- the results are published by GME by 2.00 pm on the gas day preceding the gas-day (G) subject to trading.

-

MI-GAS:

-

Trading taking place according to the continuous trading method take place every day, from 06:00 a.m. to 02:30 a.m. of the following calendar day.

Therefore, the gas-day G will be traded in the same gas-day G from 06:00 am of the calendar day G to 02:30 am of the calendar day G+1.

-

The AGS segment auction takes place every day according to the following schedule:

- the session for the submission of bids/offers opens at 08:00 am and ends at 1:30 pm on the same gas-day (G) subject to trading;

- the results are published by GME by 2.00 pm on the same gas day (G) subject to trading.

- MPL: GME, following the receipt of the request for activation of a MPL session transmitted by Snam Rete Gas, published on the MGAS information system:

- Trading hours of the session;

- Opening and closing hours for the submission of bids/offers;

- MGS:

- the session for the submission of bids/offers opens at 09.00 am on the fourth gas day preceding the traded gas day and ends at 10.00 on the gas-day following the one being traded;

- the results are published by GME by 11.15 am the gas day following the one being traded.

The results of the MPL session are published by GME within thirty minutes from the closing of the session.

- MT-GAS: every day from 9:00 a.m. to 5:00 p.m. for all tradable forward products.

|