|

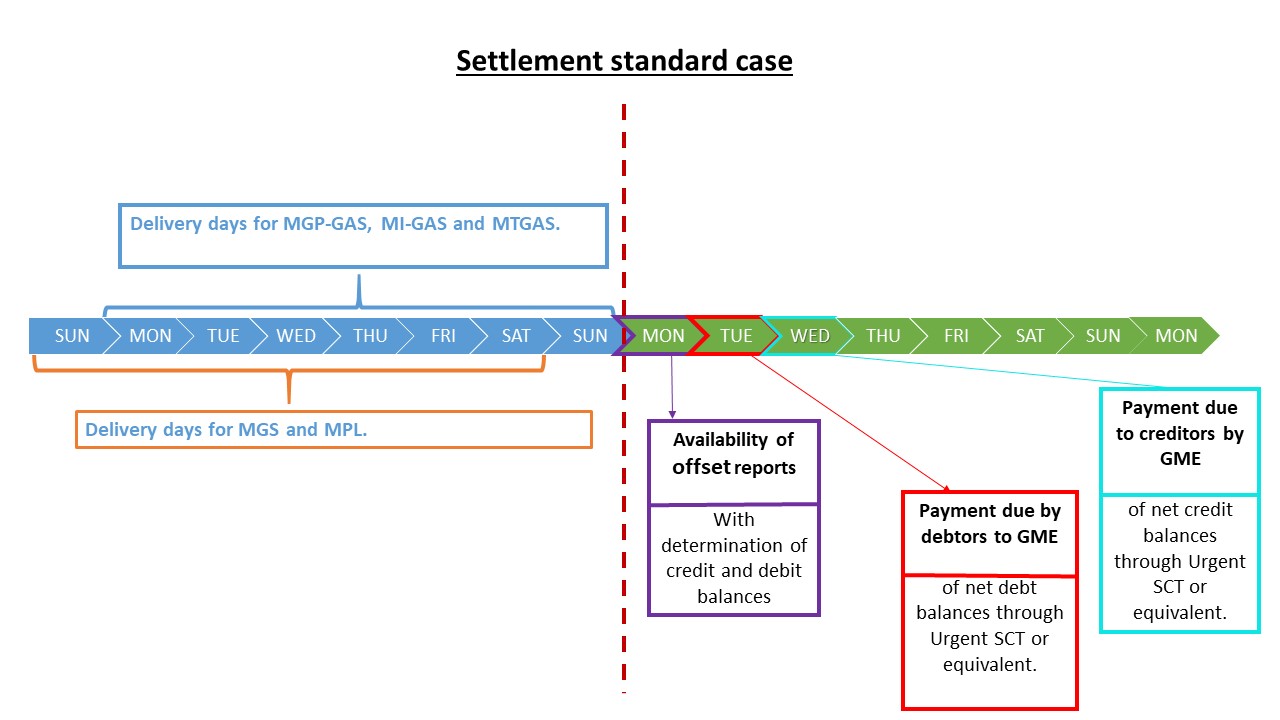

Defined W as the week in which the gas traded has been delivered, the settlement period of the payoffs relating to the MGAS is the week (W+1).

On the first working day of the week W+1, GME will determine the Market Participant's net position of debit or credit towards GME

(net balance to be settled) on the basis of the amounts (including VAT, if chargeable) resulting from the purchase and sale transactions

concluded on the MGAS and delivered in the week (W) - which runs from Monday (T-6) to Sunday(T).

If possible, GME will determine, for the sole purpose of making payments according to the procedures defined in the Technical Rules,

the overall amount due by the participant with reference to the economic items arising from the transactions concluded by the participant

in each market/platform managed by GME. An exception is represented by MGS and MPL sessions for which the week (W), for the purpose of

determination of the net position, is to be considered the one which runs from Sunday (T-7) to Saturday (T-1).

The debt or credit offset of the payables/receivables assigned to the defaulting Participants under Article 73, paragraph 73.2 c) of the

Natural Gas Market Rules is determined by GME within the fifteenth calendar day of the third calendar month following the invoicing period.

Exclusively for PA Participants, whether the determinations above mentioned prove them to be net debtors of GME, GME will settle PA Market

Participants' positions by using the non-interest bearing cash deposit granted by the same Participants as a guarantee, once completed the

billing process set out in the rules on the electronic invoicing in respect of the public administrations above.

The settlement of Natural Gas Market is arranged accordingly to a specific TIMETABLE and provides that the operator pays the net debt positions through the Sepa Credit Transfer urgent tool or equivalent, with value date on the same date.

GME shall process the payments on behalf of Market Participants' net credit positions through Urgent or equivalent SEPA Credit Transfer with value date on the same date (both for PA Participants and for non-PA Participants).

The weekly financial settlement cycle of payments through Urgent or equivalent SEPA Credit Transfer is usually organized according to the following timetable, as below represented by way of example:

Participants, that do not pay the amount due within the payment deadline provided in the appropriate Calendar, may transfer, no later than 4 p.m. of the third working day following the payment day provided, the due amount increased with default interest and a penalty by Urgent or equivalent SEPA Credit Transfer.

All payments made by Participants through an Urgent Sepa Credit Transfer or equivalent tool for the payment of net debt positions must be made using the bank details previously communicated to GME by means of a specific form - signed by the person with the necessary powers of representation and sent to GME - and addressed to the following GME bank details:

Banca Popolare di Sondrio

IBAN IT58 E056 9603 2110 0000 7210 X36

SWIFT CODE POSOIT22

If GME, by its own fault, makes the payments beyond the established time limits, it will pay default interest to creditor Market Participants; the interest rate will be equal by the pro tempore legal interest rate.

|